Paperless Home: Receipts: 3. Digitize

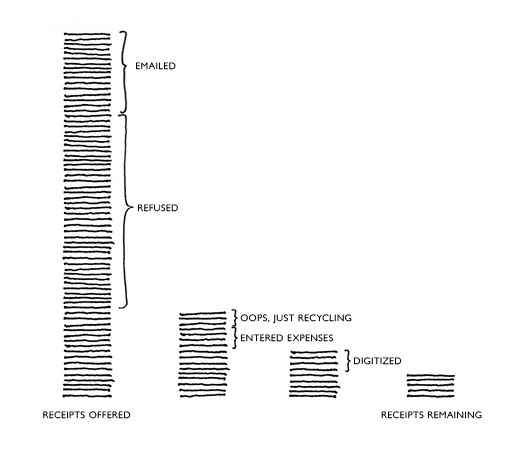

I’m working on a series to chronicle how I achieve a Paperless Home and the first project is Receipts, woohoo! Most of the receipts I’m offered are either refused or already digital. With the dozen or so per month that actually make it home with me, if I don’t record the expense and ditch the receipt...

3. I save images of them digitally: If I have deemed a paper receipt necessary to keep, I decide if I can scan it and save it digitally. Good news, the future is here! Technology has made it possible to scan, file and store everything in the cloud. They’re searchable, clutter-free and even the IRS accepts them.

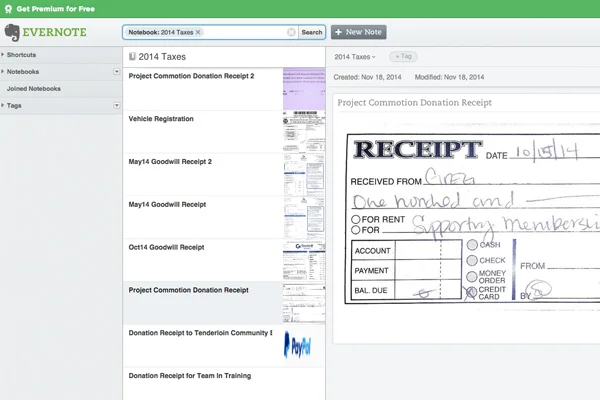

An Evernote notebook for my 2014 Taxes

I add business and tax-related receipts to an Evernote notebook titled “2014 Business Receipts” or “2014 Taxes”. Come tax time, I just export that notebook and send it to the accountant along with my yearly account statements. I actually photograph my receipts through the Evernote app on my phone because I got rid of our scanner a few years ago :) Dropbox is another great option for storing files and digital receipts.

Digital receipts stored in Dropbox

I sometimes like to have digital receipts for large purchases where insurance or warranty coverage feels important. I have about 10 of these total, but to be honest I’ve never submitted a warranty issue and needed the original receipt.

Photographing and storing receipts digitally has become the easiest way for me to track and recall business or tax receipts. It also makes for a more paperless home! Next, I’ll discuss the few physical paper receipts I keep...

+ Remember, this is what works best for me and has helped our home stay paperless. You might need a different system, especially for taxes or business receipts, so please ask your accountant if you're unsure!